At Diener & Associates, we specialize in offering comprehensive, ongoing government contract consulting services. Our aim is to assist organizations not just in obtaining but also in maintaining and managing contracts with the federal government over the long term.

At Diener & Associates, we specialize in offering comprehensive, ongoing government contract consulting services. Our aim is to assist organizations not just in obtaining but also in maintaining and managing contracts with the federal government over the long term.

This continuous support ensures that your business consistently aligns with evolving regulations and policies, safeguarding your financial interests and ensuring compliance. Our experienced certified public accountants (CPAs) are dedicated to comprehensive management of your contracts, focusing on proper documentation, regulations, and procedures to secure your earnings from the government and to successfully pass regular Defense Contract Audit Agency (DCAA) audits.

Government Agency Compliance

Ensuring Continual Adherence to Regulations

Government agency compliance is achieved when your business follows all policies and guidelines set forth by the DCAA, Department of Defense (DOD), and other government agencies. At Diener & Associates, we understand the policies and can help your business achieve compliance with the following regulations and agencies:

- Federal Acquisition Regulation (FAR)

- Cost Accounting Standards (CAS)

- Code of Federal Regulations (CFR)

- Defense Contract Audit Agency (DCAA)

- Defense Federal Acquisition Regulation Supplement (DFARS)

- Department of Defense (DOD)

- General Services Administration (GSA)

Our consulting services are designed to provide you with the expertise necessary to refine your accounting systems and business processes continuously. Our CPAs ensure that your business remains compliant with all government agencies and regulations, enhancing your chances of securing current contract awards and boosting the probability of receiving future government contracts.

Are you ready to receive comprehensive government contract consulting for your company?

Reach out today.

Government Contract Accounting

Upholding Rigorous Accounting Standards

Our government contract accounting services are tailored to certify that your organization consistently meets the accounting requirements established by the DCAA, SF-1408, and other agency requirements. This ensures that all federal funds agreed upon in the contract are rightfully retained post-completion, and that your compliance is maintained for future funding opportunities. At Diener & Associates, we employ Generally Accepted Accounting Principles (GAAP) – trusted, reliable, and certifiable accounting methods established by the government. We also utilize the DCAA’s Incurred Cost Electronically (ICE) model to reconcile your actual indirect costs incurred over the prior fiscal year with what was provisionally billed.

Our government contract accounting services are tailored to certify that your organization consistently meets the accounting requirements established by the DCAA, SF-1408, and other agency requirements. This ensures that all federal funds agreed upon in the contract are rightfully retained post-completion, and that your compliance is maintained for future funding opportunities. At Diener & Associates, we employ Generally Accepted Accounting Principles (GAAP) – trusted, reliable, and certifiable accounting methods established by the government. We also utilize the DCAA’s Incurred Cost Electronically (ICE) model to reconcile your actual indirect costs incurred over the prior fiscal year with what was provisionally billed.

In addition, our government contract accounting services include DCAA-compliant timekeeping. This refers to the recording of employees’ hours and labor costs in a way that follows the DCAA’s compliance standards. These standards include the use of the following:

- A timekeeping system that identifies employees’ labor by intermediate or final cost objectives

- A labor distribution system that charges direct and indirect labor to the appropriate cost objectives

Our DCAA-compliant timekeeping services confirm that all work performed is properly tracked using the system requirements above and that overtime is compensated for.

Government Contract Management

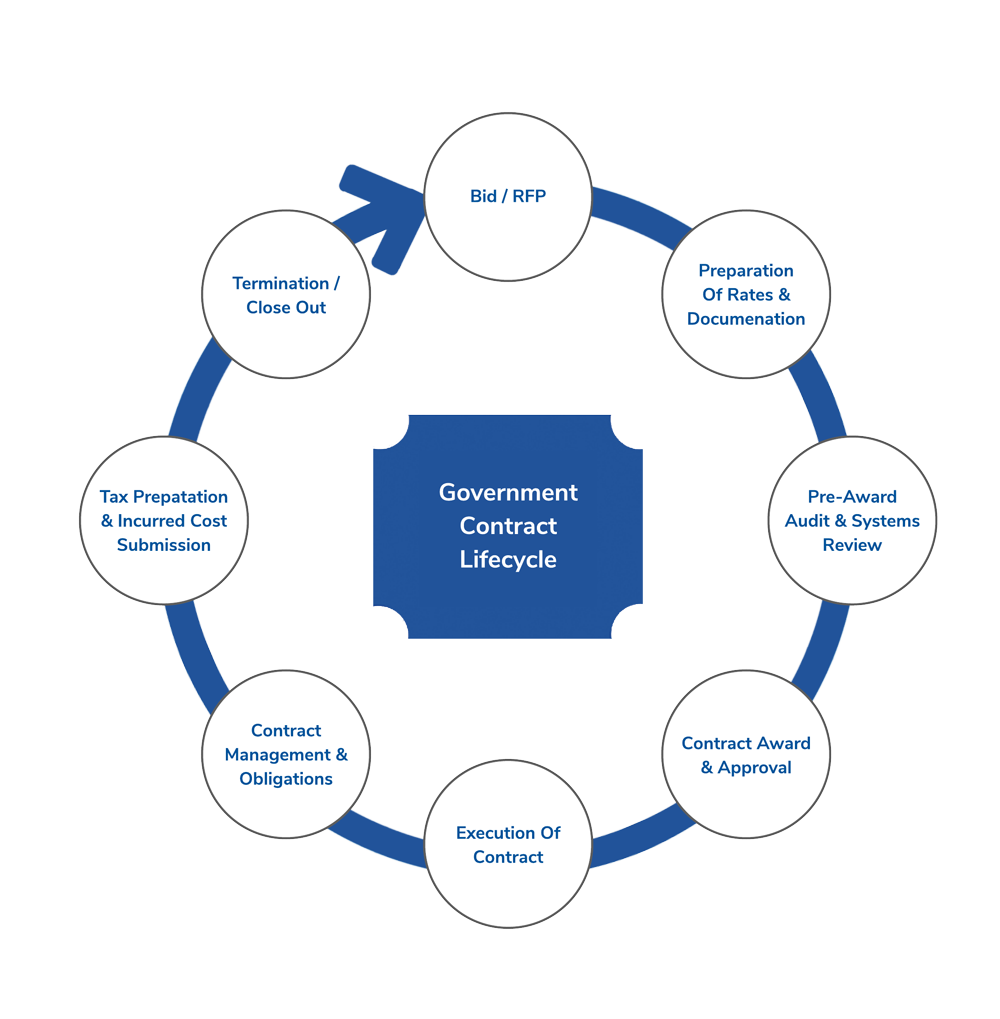

Expertise in Contract Lifecycle Management

Government contract management involves establishing and maintaining formal business relationships between government agencies and the private-sector contractors who supply goods or services to them. Working in this field typically requires specific knowledge and expertise in the procurement and acquisition process. Our government contract management services include but not limited to the following:

Government contract management involves establishing and maintaining formal business relationships between government agencies and the private-sector contractors who supply goods or services to them. Working in this field typically requires specific knowledge and expertise in the procurement and acquisition process. Our government contract management services include but not limited to the following:

- Bidding on Government Contracts

- Request for Equitable Adjustment (FAR Clause)

- Government Contract Modification

- Government Contract Negotiation

- Government Contract Proposal

- Government Contract Renewal

- Government Contract Termination

Without government contract management from a qualified CPA, your business may be subject to increased risk of not being able to do business with the federal government. Such risks include termination for convenience, being turned down for contracts, and an inability for renewal. Diener & Associates specializes in the government contracting procurement and acquisition process and can guide you through all aspects of the contract life cycle.

Speak With A Certified CPA About Government Contract Accounting Today

Your Ongoing Consulting Partner

Is your business seeking comprehensive government contract consulting? If so, contact our CPA team at Diener & Associates today. Adhering to all DCAA, DOD, and other government agency guidelines is vital for ongoing government contract acquisition and retention. We diligently work on your behalf to ensure that your accounting practices are in order and compliant with all relevant government regulations. For more information on government contract consulting or to get started, contact Diener & Associates by phone at 703.386.7864 or schedule a consultation online online today.